Reader opinions:

(35)| (59)Anyone who buys a condominium should not only pay attention to the purchase price. Housekeeping is another important cost factor. How the house money is calculated, how high it can be and what owners have to pay attention to.

Contents overview

What is housing allowance?

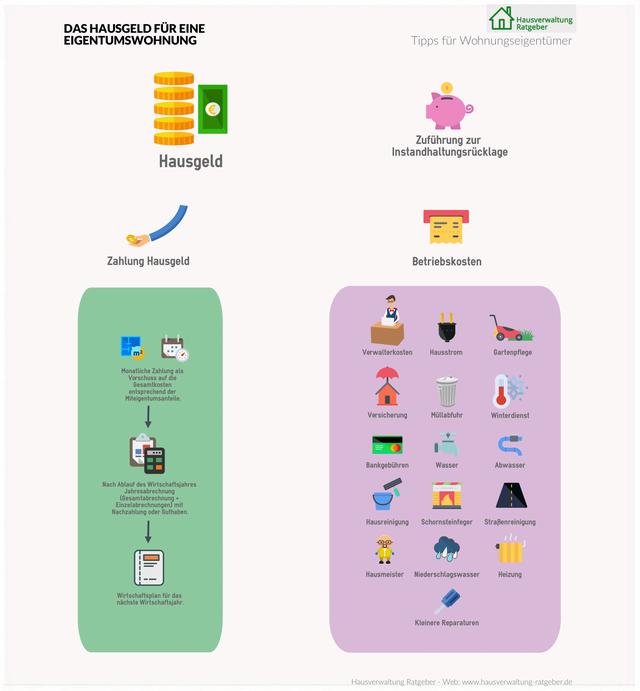

The housing allowance for the apartment is an advance payment that every apartment owner pays monthly to the property manager of the apartment owners' association (WEG). This calculates the housing allowance at the end of the year. If it was set too low, the owners may have to make additional payments, if it was set too high, there will be repayments. The house money is therefore a kind of advance payment for ancillary costs for the owner.

The household allowance includes all ongoing operating costs such as house electricity or waste disposal, administration costs and the maintenance reserve.

According to rough estimates, the housing allowance for an apartment is usually 20 to 30 percent more expensive than the operating costs of a tenant.

What is the difference between housing benefit and housing benefit? In everyday life, the terms housing allowance and house allowance are often used as synonyms for the common costs of a homeowners' association. However, the correct term for this is house money, since it means the money that the co-owners usually have to pay monthly for the management, administration and repair of the common property.

Housing benefit in the actual sense, on the other hand, is a state social benefit with which low-income citizens receive a subsidy for their rent.

What is part of the housing allowance?

The housing allowance, which is referred to as burdens and costs in the Housing Ownership Act (WEG), covers on the one hand the conventional operating costs, which can also be passed on to the tenant when renting (§ 1 Works KV). These include, for example, the running costs for:

These costs are part of the housing allowance

But there are also other costs that owners have to bear themselves - and landlords are not allowed to pass them on to the tenant:

What is not part of the housing allowance?

The property tax is not included in the housing allowance, since the apartment owner has to pay it directly to the municipality. However, if you rent your apartment, you can pass this cost on to the respective tenant. Some insurance policies, like landowners liability insurance, often require owners to pay separately as well.

In addition, there are the following outputs:

How is the amount of the housing allowance determined?

The amount of the housing allowance and also the maintenance reserve is initially determined by the property manager. dr Carsten Brückner, specialist lawyer for tenancy and residential property law and chairman of the Haus und Grund owners’ association in Berlin, explains: “He draws up a business plan in which he lists the expected income and expenses and uses this to derive the amount of the house money.”

In the next step, the business plan must be decided at the annual owners' meeting: A simple majority of the owners is sufficient for this (§ 28 WEG). Not everyone always agrees with the amount of housing allowance or maintenance reserve - but changes are possible: "The apartment owner can submit an application for the costs to be set higher or lower. Here, too, it is sufficient if the simple majority agrees,” explains Dr. Bruckner.

Corona Update

Once a year, the property manager has to present a business plan at the owners' meeting. The regulations due to the corona pandemic have been extended until August 2022. Economic plans will now continue to apply until a new decision is made. The costs for housing allowance will therefore not change for the time being. If the caretaker's contract expires, it will continue to run until the next meeting.

How is the housing allowance distributed?

Like the maintenance reserve, the housing allowance is usually distributed according to the co-ownership share - unless the apartment owners have decided otherwise (§ 16 paragraph 2 WEG). The co-ownership share is stated in the declaration of division and is usually given as a calculated fraction of the common property. The homeowners' association can also decide on its own distribution of costs for each cost item, for example according to consumption or the number of people in the household. There is one exception: "If there is a shared heating system, the heating costs must be billed in accordance with the Heating Costs Ordinance," says legal expert Dr. Carsten Brueckner.

Link tipHere you can find out how decisions are made in the community of owners and where you should pay close attention to the declaration of division.

How much house money is normal?

There is no general answer as to whether the amount of house money is reasonable. Specialist lawyer Dr. Carsten Brückner explains: "The housing allowance includes costs that can be passed on and those that cannot be passed on - these vary depending on the characteristics of the property." The size of the condominium also says nothing about the amount of the costs. Brückner explains: "A luxurious, small residential complex can certainly be more expensive than a simple, large one." For example, if there is a large green area whose maintenance has to be paid for or if the house has an elevator.

Do owners have to pay housing allowances when they are vacant?

Whether an apartment is vacant or inhabited, it is irrelevant for housing allowances. The apartment owner must pay the house fee once it has been determined in full. However, he can get at least part of the money back from the annual statement – such as those costs that are calculated according to consumption.

What belongs in the household allowance statement?

After the end of the billing period - usually a calendar year - the administrator must review the business plan. He must send the corresponding house fee statement to the owner. Specialist lawyer Dr. Carsten Brückner explains: "The house fee statement must show exactly how much house money was paid, whether an additional payment or repayment is due and what proportion was received for maintenance."

It must also be clear how the ancillary costs were distributed: the distribution key must be specified for each cost item in the business plan - sewage, garden maintenance or elevator - so that the owner can check for himself whether his share has been calculated correctly.

By the way: Owners also have to pay the housing allowance if the approval decision has been contested, because the business plan is the basis for the owners' obligation to pay.

What happens if an owner owes house money?

According to the Home Ownership Act (§ 27 Para. 1 No. 4 WEG), the administrator is obliged to ensure that every owner pays his house money. If someone is in arrears, the administrator must take appropriate action and assert this in court. A single rental owner is not entitled to do this.

In order for the administrator to be able to act accordingly, however, he must also be authorized to do so by the community regulations. Alternatively, this can also be through an authorization in the management contract or on the basis of a corresponding resolution.

If at the end of the year other owners are in arrears with the housing allowance for their apartment, the other owners may have to pay for it. This is due to the fact that homeowners' associations have partial legal capacity and so there is limited joint and several liability. However, the homeowners association can take action against defaulting owners.

Can the housing allowance be passed on to the tenant?

The landlord can only pass on the ancillary costs that can be passed on to the tenant. It is also a prerequisite that this has been effectively agreed in the rental agreement.

Management costs and maintenance reserves cannot be passed on to the tenant.

Correctly billing apportionable additional costs - tips for landlords

Fachanwalt Dr. Carsten Brückner explains the billing method: "The landlord should not forward the annual statement of the homeowners' association directly to the tenant, but must use the corresponding distribution key according to the rental agreement." This can become more complicated if the landlord uses a different distribution key for the utility bill to the tenant than the community of owners: For example, if his sewage costs are billed according to living space - but he wants to bill the tenant according to consumption.

As a solution, Dr. Brückner is about setting the same distribution key in the rental agreement as was agreed according to the homeowners' association. "He should also write in the rental agreement: 'In the event that WEG changes the distribution key, I reserve the right to use this key in the rental agreement as well'."

Link-TippRead here how to calculate the additional costs correctly.

Who pays the housing allowance when selling an apartment?

It depends on the time of the sale, because the settlement of the last billing period for the housing allowance is often still outstanding on the sales date. However, the billing, as well as the resulting additional claims or credits, only arise after the corresponding resolution of the community of owners on the annual billing.

This means: If ownership is transferred to the new owner and the homeowners' association then decides on the annual accounts, the buyer must pay for the following bill. If the community of owners first decides on the annual accounts and then the transfer of ownership takes place, the seller must be responsible for the house money bill.

In order to avoid disputes here, both parties should remember to include a regulation for these cases when drawing up the purchase contract, here the notary can provide advice.

Tip for homebuyers: check the business plan carefully

Prospective homeowners advise legal expert Dr. Carsten Brückner to take a close look at the condition of the property before buying it – for example how good the facade is. You should also ask the seller or broker exactly: "Have there ever been decisions about repairs, maintenance measures or modernization?"

A look at the business plan or minutes of the meeting also provides information as to whether repairs are pending or have been postponed in recent years: If the maintenance reserves are low but the need for repairs is high, the homeowner can face expensive special charges.

Link-TippApartment owners have to pay other costs in addition to the housing allowance: property tax, insurance premiums and more – find out at a glance what costs you will incur when you buy a condominium.

we recommend

Find a house or apartment

Search real estateRegine Curth05.01.2022Your opinion counts

(35)4.8 out of 5 stars5 stars 304 stars 43 stars 02 stars 01 star 1Your rating:| (59)Share this post

share59 Comments

Ole74 on 09.01.2022 14:46

Hello everyone,

6 apartments in a community of 80 apartments have a separate entrance and no access to the hallway and staircase. Can the stairwell cleaning be passed on to these parties as house money, although it is not permissible to pass it on to the tenant?

Thanks for the replies

reply to commentLichtshein on 06.12.2021 10:25

Hello everyone I have a question, do I have to pay the non-recoverable costs from other owners at the end of the year if you are in arrears? Thanks

reply to commentimmowelt editorial staff on 08.12.2021 08:15

Hello Lichtshein,

Owners' associations have partial legal capacity, so there is (limited) joint and several liability. You may therefore have to pay for the costs of other owners. However, the WEG can take action against defaulting owners, for example.

Please understand that we cannot and may not provide legal advice. If in doubt, you should contact a specialist lawyer or an owners' association.

Best regards

the immowelt editorial team

do not have a username on 11/28/2021 13:44

If e.g. B. Bank charges settled by apartment or shares?

reply to commentredaktion.immowelt.de on 29.11.2021 10:59

Hello,

You cannot include account management fees or similar in the house money. Only ongoing operating costs such as house electricity, waste disposal, administration costs and the maintenance reserve are included in the house allowance.

Best regards

immowelt editors

Else Kling on 07.11.2021 05:36

Hello, our administrator got help/support from Haus&Grund for the preparation of the utility bill and wants to pass these costs on to us owners. Is that legal? Doesn't he have to pay for the house and land from his "caretaker's salary"?

reply to commentimmowelt editorial team on 09.11.2021 15:52

Hello Else Kling,

That depends on what was agreed in the management contract and whether it represents a service that he could not have provided himself as part of his management activities. Please understand that we cannot and may not provide legal advice. For a legally secure answer, you should contact a specialist lawyer or an owners' association.

Best regards

the immowelt editorial team

lino on 08.09.2021 18:10

Hello, I would like to voluntarily add my monthly Increase payment of house money to avoid an additional payment later. However, the property management claims that only the house money is collected, the amount of which was determined by the property management in the last and still current agreement of the owners' meeting. How can I assert myself? Is there a paragraph for that?

reply to commentMark on 28.10.2021 23:43

I think the property manager is right. You are free to put some money aside yourself.

beltz on 08/18/2021 09:40

Hello,

I have a question about the new WEG.

The property manager claims that the credit (€600) from the 2020 electricity bill that arrived in the account in 2021 cannot be booked back in 2020?

reply to commentg. Wank on 07/21/2021 15:21

GN Wank 21.jul.2021

My condominium since January 2020 due to water damage/mould, uninhabitable to this day. The alleged cause of the damage was an outdated water pipe. Even at my own expense I would have to rent a temporary apartment. What costs/surcharges do I have to pay as the owner in this situation for the individual house fee billing?

reply to commentLichtner on 04/24/2021 15:55

According to the division in the declaration of division, which has not changed since it existed, there are 11 residential units. From 2004 until the accounting year 2019, an apartment owner of 2 condominiums only has to pay 1 management fee. In 2019 she only needs to pay it once for a tax certificate instead of twice for her 2 WE.

Since 2004, the administrator has been covered by proper accounting by the advisory board. So that the administrator was relieved and the advisory boards themselves too. The one who receives the cost reduction from the administration relieves herself because she is also an advisory board member.

So she received a cost reduction of

€5,180.77

compared to the other WEers.

The administration should change the 2019 house allowance statement to 11 units as in the declaration of division, but they don't do that.

Where should I contact the district court under Section 43 WEG so that the administrator enters 11 units in 2019 and the preferential treatment ends?

reply to commentYogatina on 21.04.2021 22:48

In the purchase contract, the condominium and the underground parking space are listed separately as separate property.

For 20 years there was only one annual statement. The new manager insists on 2 separate bills for the apartment and parking space, there are 2 manager fees.

Is that really prescribed in the WEG, I couldn't find anything?

Reply to commentHello Yogatina,

This is very difficult to judge from a distance. Please understand that we cannot and may not make any legally valid assessments. We advise you to contact a specialist lawyer or owners association.

Best regards

immowelt editors

Didi on 02/19/2021 11:57

Please make corrections!

You write: What is house money?

House money is the advance payment that the homeowner pays monthly to the property manager of the homeowners' association (WEG) and that is settled at the end of the year.

The apartment owner does not pay the housing allowance to the manager, but to the association of apartment owners. The administrator has the right of disposal over the WEG account.

Thank you!

reply to commentSiggi41 on 03.02.2021 19:59

Can the costs of maintenance for pure building services systems of the condominiums of a condominium be settled in the operating cost statement according to ET shares, including the square meter shares of underground parking spaces?

Underground parking spaces are neither heated nor do they require maintenance.

Who can give a legally sound answer here?

Thank you.

reply to commentKrücker on 02/01/2021 19:06

Hello!

My question!

There are three condominiums in our house, all owners live in the apartments.

In the middle of last year, the couple separated in the downstairs apartment.

My question would be, will the statement be calculated until you move out or until you re-register?

The man and the child are still registered here.

Thanks for an answer

Greetings Birgit Krücker

reply to commentGabriele D. on 02.11.2020 19:02

Hello,

I have two questions about the settlement of additional costs after a change of ownership.

1. Does the new owner have to pay back payments made by the old owner to the property management company? The new owner must then obtain the additional payment from the old owner. Is that legal?2nd question:

The previous owner only recognizes repairs that were made during his time of ownership. However, the property management distributed all repair costs incurred over the year and passed them on to all parties. Is that legal?

lG Gabriele D.

reply to commentHans 6 on 09/18/2020 07:34

Hello!

The residential complex consists of 90 apartments. Now the renovation of the underground car park with an estimated 200,000 euros is pending. Each apartment has its own parking space. Therefore, the apportionment according to apartment size is illogical. How do you see it?

reply to commentNIK Sinner on 17.09.2020 23:09

I live as the owner of a property consisting of a front and rear building. The front building wants to buy a new boiler and the property management thinks I have to help finance it, although we have neither a boiler nor connections for it in the rear building, because we heat it with electricity/night storage. When I asked many years ago whether one could connect to the central heating, it was said no, we should buy our own boiler and have the pipes laid at our own expense. Back then, when the boiler was installed in the front building the owners of the front building paid for it without the rear building.

do I have to pay for something that we don't use?

Thank you in advance

reply to commentMaria Block on 03.09.2020 13:08

We save 5,000 euros a year on repair costs as a condominium owner; the homeowner can constantly demand amounts in excess of my income

reply to commentNaim84 on 08/26/2020 22:56

Hello

As the owner of a 3-family house with oil heating, do you have to pay for additional hot water?

So fresh and waste water for heating

Oil costs

Hot water costs

Heating costs

Thank you for more information

reply to commentDietmar on 07.06.2020 13:41

Hello Immowelt editors,

At the end of 2015, I acquired an undeveloped top floor as private property no. 5, in a house that had 4 residential units for decades. According to the declaration of division, my private property is exempt from all housing benefit costs until the start of construction. In mid-2017 I received the building permit. From then on I was asked by the property management to pay the full housing benefit.

My 1000th share is significantly higher than that of the other 4 apartments, especially since there is a large basement room.

At the end of 2017, I complained to the property management about the high costs without causing any consumption. As a result, it was decided in an extraordinary meeting of owners that I would at least be freed from garbage costs and from water/wastewater until completion, i.e. habitability of the attic. Now the other 4 owners would like to collect the complete housing benefit costs according to 1000ths retrospectively for 2019, although it can be proven that no consumption took place at all. Yes, it couldn't take place at all, because the expansion has been suspended since the end of 2018 for health reasons.

Is this legal?

In addition, the other 4 apartments of 4 people each, with very high consumption

Costs inhabited while I'm alone and don't cause any consumption, can't even cause it.

Is that legal too?

Note: Lt. Declaration of division, the payment of the house or Housing benefit after 1000th.

Thank you in advance for your valued reply.

Thank you very much and remain

Best regards

Dietmar

Reply to commentdietmar on 06/09/2020 13:11

Hello Immowelt editors,

I confess that I am very dissatisfied with your answer.

I tried to enter as much information as possible so that a meaningful answer can arise. With regard to your mention in the land register, this almost gives me the impression of missing the point. It is clear that the WEG, to which I belong, of course, can make different agreements. The only question that remains is: do I have to bear the water for the other, larger families when I convert my attic floor, i.e. consumption-dependent costs, even though I don’t have a water extraction point in the attic. Just like I don't have a garbage can there.

My place of residence is somewhere else.

Furthermore, the question arises as to whether the agreement concluded at the end of 2017 to exempt me from the costs for water and garbage until the top floor is habitable can now be arbitrarily and retrospectively overturned for 2019. In the end, that would mean that I generously pay the water for the other 4 units with most of the 1000th shares.

Best regards

Dietmar

immowelt editorial team on 06/10/2020 09:22

Hello Dietmar,

From our point of view, since it was agreed that an exemption from housing benefit/operating costs was only agreed until the start of construction, you are obligated from the start of construction, at least as far as the cold operating costs are concerned, because your unit is already part of the WEG. According to the law, the cold operating costs are billed according to area, but deviating agreements are possible, e.g. according to the number of people or, in the case of cold water, according to actual consumption if water meters are installed. In principle, it is the case that proportionate costs must also be paid if an apartment is vacant, for example. From our point of view, the agreement with the other co-owners that you are exempt from part of the costs until construction is complete cannot simply be withdrawn arbitrarily. Unfortunately, a final and legally reliable assessment from a distance is not possible for us.

Best regards

the immowelt editorial team

immowelt editorial team on 06/09/2020 08:20

Hello Dietmar,

Remote specific diagnosis is not possible here. In principle, however, it is true that the obligations of the owner basically exist from the point in time at which the unit is available in the land register. Of course, the WEG can make deviating agreements.

Best regards

the immowelt editorial team

Björn on 06.06.2020 15:08

Do I state the paid house money (total) as an expense in the tax return? (As a landlord of an AP)

And then in the next year the credit (if one comes) then again as income?

I'm stuck :(

Reply to commentHello Bjorn,

To put it very simply: What was spent in this year is deducted from what was received in the tax year. You should discuss the details with your tax advisor.

Best regards

the immowelt editorial team

Eberhard Schneider on 04.06.2020 17:22

Are the tax advice costs for a condominium included in the property manager costs? Does WEG incur additional tax consultancy costs from the property manager? Unfortunately, nothing can be found anywhere about this problem. Maybe someone knows an answer? Thanks in advance The administrator charges €5.00 + VAT per unit for the management of an underground car park with 161 spaces.

reply to commentimmowelt editorial team on 05.06.2020 10:37

Hello Eberhard Schneider,

we cannot fully understand the specific constellation. When it comes to the property manager hiring a tax consultant on behalf of or in the interests of the tenants, these costs must be paid by WEG, just like craftsmen’s bills must be paid.

Best regards

the immowelt editorial team

Eberhard Schneider on 04.06.2020 17:22

Are the tax advice costs for a condominium included in the property manager costs? Does WEG incur additional tax consultancy costs from the property manager? Unfortunately, nothing can be found anywhere about this problem. Maybe someone knows an answer? Thanks in advance The administrator charges €5.00 + VAT per unit for the management of an underground car park with 161 spaces.

reply to commentRenate Weingart on 04/10/2020 04:13

Hello,

I bought a condo last year. This was not ready for occupancy at the agreed time. At first I lived with a friend. When they needed the space themselves, I moved into the unfinished apartment. There was not regular hot water here, no heating or it could not be regulated at times, so that in the apartment it was sometimes 40 degrees and more. Garbage collection has only been available since March of this year. The administrator was appointed on April 1st, 2020. This is now demanding house money from me from 01.01.20. The house is still not finished at the moment. Does this requirement have a legal basis? All apartments are not yet ready for occupancy. Can the administrator act like this?

Best regards

Reply to commentHello Renate Weingart,

Here it should depend on the contractual regulations. If the contract was concluded after a certain point in time and the administrator is actually active in administration, he can demand his remuneration, regardless of whether the apartment is inhabited or not.

Best regards

the Immowelt editorial team

M&B on 04/08/2020 14:14

Hello,

We received the annual statement of house money and a refund. The monthly advance payment was nevertheless increased because of the expected general increase in costs, but above all with the argument that this was required by law.

Is that really the case?

Thank you for your information.

Reply to commentHello M&B,

We don't know the specific constellation. But there is no legal requirement that the landlord has to increase the advance payments in the form you describe. It is true that both sides (tenant and landlord) may adjust the advance payment if there is a reason for this, § 560 BGB: "(4) If advance payments for operating costs have been agreed, each contracting party can make an adjustment by declaration in text form after settlement make a reasonable amount."

The landlord may have to justify the expected increase in costs. An increase based purely on assumptions is not permissible.

Best regards

the Immowelt editorial team

Angela on 03/30/2020 21:40

Hello,

Hello,

Hello, according to the composition of the operating costs, the major repairs are listed in the "non-allocable costs" and these same costs are also listed in the advance payments! Is it correct that way? The amount does not have to be deducted once instead of being added twice.

reply to commentImmowelt editorial team on 03/31/2020 09:50

Hello Angela,

The costs for larger repairs are not settled via the utility bill, but are usually financed from the maintenance reserve or, if this is not sufficient, via a special contribution from the owner.

Best regards

the Immowelt editorial team

Angela on 04/01/2020 07:54

Thank you for your feedback.

In this case, however, it is a total bill for the owner of the apartment and not for the tenant! Is it the same in this case? The major repair has already been paid as a special contribution, but is it still shown again in the "non-reimbursable costs"?

Immowelt editorial team on 01.04.2020 11:57

Hello Angela,

Since we don't know the document, we can't judge it from a distance. Possibly. This is an overall list.

Best regards

the Immowelt editorial team

Ottmar on 05.03.2020 12:55

We purchased a condo on March 1, 2020. Does the property management have to split the house allowance bill for 2020 according to WEG (2 to 10 months) or do I, as the new owner, get the entire house money bill for 2020, which I then have to split up with the previous owner for the time of his use, 2 months?

The contract of sale stated that all costs and burdens would only be transferred to us from March 1st.

Reply to commentImmowelt editors on 06.03.2020 09:44

Hello Ottmar,

Since this is probably a pure property management and not a separate property management, we tend to say that the property management is only obliged to settle accounts with the current owner.

Best regards

the Immowelt editorial team

SKR1971 on 01/20/2020 10:01

I only have a garage via the long-term lease, so no condominium for the entire property. The house money amounts to only 30 €/month for the garage + respective hereditary rent. Therefore, a rental would be +- zero. I can not understand the business plan by the property management.

I have no cohesion with the building, i.e. the respective reserves are separate garages and buildings. Nevertheless, I have to pay for the maintenance of the heating, room sensors, etc. through operating costs. Of course I pay for all electricity, house service, garden maintenance, etc. Is there a reputable place somewhere that I can send my documents to for verification at a reasonable cost. Unfortunately, a consultation with the property management does not work. I can pay, but my questions and concerns are consistently ignored. I'd appreciate advice on whom to turn to. Thank you in advance.

reply to commentImmowelt-Redaktion on 21.01.2020 12:06

Hello SKR1971,

In principle, you can contact a specialist lawyer with legal questions (initial consultation may not cost more than 190 euros plus VAT, some lawyers even offer this free of charge) or an owners' association such as Haus&Grund.

Best regards

the Immowelt editorial team

Doris on 01/11/2020 21:44

In our 2-family house with a separate apartment there is a tiled stove in the ground floor apartment, which is also used to heat the apartment on the 1st floor. Due to age, the combustion chamber must be replaced. Are the costs to be borne entirely by the owner of the ground floor apartment or does the owner of the upper apartment have to contribute to the costs?

reply to commentDoris on 01/11/2020 21:44

In our 2-family house with a separate apartment there is a tiled stove in the ground floor apartment, which is also used to heat the apartment on the 1st floor. Due to age, the combustion chamber must be replaced. Are the costs to be borne entirely by the owner of the ground floor apartment or does the owner of the upper apartment have to contribute to the costs?

Reply to commentImmowelt editors on 13.01.2020 11:23

Hello Doris,

is the 2-family house divided according to WEG? If that were the case, the fireplace would belong to the common property, but the tiled stove to private property; where it then also depends on the specific provisions in the declaration of division.

Best regards

the Immowelt editorial team

Ottilie on 03.12.2019 03:04

Bought only one underground parking space in a community of owners. There has been a process going on there for several years. Do I also have to pay these fees for house money, e.g. for legal advice, expert opinions?

reply to commentImmowelt-Redaktion on 03.12.2019 10:51

Hello Ottilie,

Thank you for your comment. According to a judgment of the Federal Court of Justice, the court costs and costs of the lawyer in a condominium association are usually to be distributed among all owners in the annual statement, if necessary including the winning defendant owner (BGH, Az.: ZR 168/13).

Please understand, however, that we cannot assess whether this fully applies to your situation and we cannot provide legal advice. If in doubt, we advise you to contact a specialist lawyer for condominium law or an owners' association such as Haus und Grund.

Best regards

the Immowelt editorial team

SHL on 12/02/2019 14:53

Hello real estate,

I am an apartment owner in a house with about 30 apartments (and about 25 owners), but only I and 2 other owners live in my own apartment. Our WEG administration therefore also does the rental management for 27 residential units in the house. Do owners who live in the house themselves (and therefore have no tenants) also have to help finance the rental management?

reply to commentImmowelt-Redaktion on 03.12.2019 08:30

Hello SHL,

The management of the WEG and the rental management are two different types of property management and should be treated accordingly. While the WEG manager takes care of the common property, the rental manager is exclusively responsible for the tenancies. Although both tasks can lie with the same person, the two must be strictly separated from a legal and monetary perspective. Who pays for the costs now depends entirely on the client. If WEG is a contractual partner, the entire WEG also bears the costs - unless otherwise agreed. If the individual owners who rent out their apartment are contractual partners, then only they pay.

However, please understand that we cannot and may not provide legal advice. For a legally secure answer, we recommend seeking advice from a specialist lawyer or an owners' association.

Best regards

the Immowelt editorial team

Bismarck on 11/27/2019 11:34

Hello, I am the manager of a three family house. We have an owner who only causes stress. The latest highlight, she refuses to pay the reserves because I didn't send her the receipts for the reserve account. I have asked her to consult me several times, although she is often here in the house. A lawyer has now initiated dunning proceedings. From which account (house money or reserves) can I pay the court costs in advance?

reply to commentImmowelt-Redaktion on 28.11.2019 08:33

Hello Bismarck,

We would tend to think that these costs should not be taken from reserves. To be on the safe side, however, you should ask the lawyer what the correct procedure is.

Best regards

the Immowelt editorial team

Bernd Nickaes on 31.10.2019 20:32

Hello,

I live in a house with different owners. 6 apartments have a size of 138 square meters, 3 of 103 square meters and 2 of 168 square meters.

.2 of the 138sqm apartments have a garden. The ownership shares are listed as follows in the parts declaration:

For all 138sqm apartments977/10000

for all 168 sqm apartments 1000/10000

for 2 of the 103sqm_wolnungwn 705/10000

and for a 103 sqm apartment 569/10000 share.

All 103sqm apartments are identical.

Is the division correct?

Can I have the parts declaration changed?

How can I calculate my share?

Please reply:

Dande Bernd

Reply to commentImmowelt editors on 04.11.2019 10:54

Hello Bernd Nickaes,

With regard to your information, it seems to us that the /10000th shares do not mean the garden shares to be used individually by the individual owners, but the co-ownership shares in the entire system. However, without precise knowledge of the declaration of division, we cannot make a final assessment of its correctness from a distance. With regard to the different co-ownership shares in the same apartment size, however, this is noticeable at first glance. If necessary, you should have a specialist lawyer check on site whether this is correct and, if not, whether this could result in disadvantages for you.

Best regards

the Immowelt editorial team

Gabriele on 15.10.2019 13:55

Hello Immowelt editors,

We have had a holiday home for more than 30 years that is not rented out. 15 years ago we had the existing balcony glazed, fitted radiators and opened it up completely to the living room.

The apartment owners then changed the cost allocation key for our apartment and the amount of our maintenance reserve was increased as a result.

Unfortunately, I only found out a few months ago that the new square footage of our apartment calculated by the administrator after our balcony glazing was set too high. The administrator has already seen his calculation error. He added the full area of the balcony to our existing living space, although the balcony was always calculated with half of its square meters. The balcony has an area of 10 square meters, the apartment including half a balcony has 39 square meters according to the declaration of division. The size of our apartment was determined by the apartment community to be 49 square meters after the balcony had been renovated.

Can I ask the apartment owners to correct our apartment size and possibly refund the overpaid maintenance costs?

reply to commentImmowelt-Redaktion on 16.10.2019 09:33

Hello Gabriele,

Most claims become statute-barred after the three-year statute of limitations according to § 195 BGB. However, it is not possible to judge from afar whether and which claims you can still assert.

Best regards

the Immowelt editorial team

Horst on 07.10.2019 17:24

Hello Immowelt editors,

An owner moved out of a three-family house in November 2018, but only sold the apartment in July 2019. During this time he did not pay any housing benefit, although he would have been obliged to do so (as I have read from some responses to comments). Now the settlement is pending and I would like to know which of these ancillary costs the owner who has moved out can be charged with: fire insurance, residential building insurance, account management fees, rainwater fees, chimney sweeps, garbage disposal fees, shared electricity consumption, reserves.

reply to commentImmowelt-Redaktion on 08.10.2019 09:06

Hello Horst,

When it comes to the question of whether non-consumption-dependent operating costs can be settled with an owner, it does not matter whether the owner still lives in the apartment, because the non-consumption-dependent operating costs are incurred regardless of how the apartment is used.

Best regards

the Immowelt editorial team

Ulrike Rockenfeller on 06.10.2019 12:51

to the Immowelt editorial team,

Hello, I came to the "administrator" like the mother to the child and would like to settle everything correctly, for the administrator billing.

Now I'm debiting the housing allowances of the individual owners; I state these amounts with or without VAT. These amounts are booked by the owner to a clearing account in the house community.

Thank you for your information.

reply to commentImmowelt-Redaktion on 07.10.2019 10:51

Hello Ulrike Rockenfeller,

If it is a residential property that belongs to private owners, there is no advance tax deduction, i.e. all invoice amounts are gross.

Best regards

the Immowelt editorial team

rot123sabine on 29.09.2019 22:01

Hello, you write in the housing allowance that this is to be paid by all owners according to the ownership shares. But what if an owner lives in the entire house. Does this tenant have to pay?

Reply to commentImmowelt editors on 30.09.2019 11:34

Hello Sabine,

Unfortunately we do not understand your situation exactly. Could you describe the situation in more detail? House money is due for several apartments, which usually have one owner each, otherwise it is not a community of owners.

If you provide us with a little more information, we will be happy to answer your request in more detail.

Best regards

The Immowelt editorial team

rot123sabine on 30.09.2019 12:08

Hello, two siblings share a house equally. One of the siblings lives in the entire house, the other does not. Who has to pay housing allowance and who has to pay rent?

Immowelt editorial team on 09/30/2019 15:23

Hello rot123sabine,

If the siblings have founded a WEG, there is also an administrator (can be one of the siblings) who determines the amount of house money that all owners pay according to the fixed distribution key, regardless of whether they live in the apartment themselves or not. A landlord can negotiate a rental price with his tenant and also charge the operating costs (i.e. the house money, but not the administration costs or reserves).

Best regards,

the Immowelt editorial team

Octavian on 09/13/2019 22:54

Hello, I also have a question.

I have been the owner since 2013. A house allowance statement has not been made since 2016. Since January 2019 we have a new property management. They corrected the old bills and sent letters to the owners. I have to make an additional payment of 374 euros for 2018 and my contribution to house payments will be increased by 65 euros per month. But the property management calculates this increase reversed from January 1st, 2019 and therefore they will debit me 650 euros on October 2nd, 2019. In addition, the additional payment and the housing allowance for November plus an increase, which finally makes a total of around 1400 euros. The business plan for 2019 will be approved on 10/01/2019 (property meeting teemin).

My questions are :

1.May the property management just reverse the debit?

2.I have an opportunity to do something about it because I don't find an immediate debit of 1400 euros a matter of course?

Thank you in advance

Best regards

Reply to commentImmowelt editors on 16.09.2019 11:04

Hello Octavian,

In contrast to tenancy law, where a late settlement is no longer borne by the tenant, the situation is different in the case of condominium ownership. WEG administrators are obliged to proper accounting. The administrator is also not a third party who writes any invoice, but the WEG, and therefore you too, have commissioned the administrator with the administration; he does not issue an invoice on his own behalf, but is the owner's vicarious agent. If the administrator did not claim the costs actually incurred from the owners, the WEG would eventually go broke.

You might want to talk to the manager, for example, whether payment in installments is possible.

Best regards

the Immowelt editorial team

Alexandru on 09/06/2019 19:01

Dear Editor,

We live in a 2-family house (BJ. 1966). Our apartment is 83 sqm and the other apartment is 112 sqm. However, a half-sharing of costs is agreed in the declaration of division. However, we are of the opinion that the total costs should be divided according to the living space. The question is: how is the house money divided in this case? According to the declaration of division or according to the square meters? Thanks in advance!

reply to commentImmowelt-Redaktion on 09.09.2019 11:24

Hello Alexandru,

The regulations on cost sharing in the law or in the declaration of division apply. This means that what is written in the declaration of division applies for the time being. However, the apartment owners can decide to change the cost distribution key (§ 16 Para. 3 and 4 WEG).

Best regards

the Immowelt editorial team

sherrynino on 08/23/2019 12:24

Can a property management pass on the costs for the DSVGO to the owners of the apartments?

reply to commentImmowelt-Redaktion on 26.08.2019 09:20

Hello sherrynino,

The costs that a property management company can charge for are regulated in the management contract, so we are unable to assess your case individually. In principle, however, it should be possible for a property manager to be able to bill the manager for the costs that he actually incurs for the condominium within the framework of the GDPR, unless the condominium contract already regulates that costs of this type are already included in are included in his base salary.

Best regards

Immowelt editorial team

Manfred on 07/19/2019 2:41 p.m

6 apartments have radiators as separate property. 7 apartments have underfloor heating, which is common property? Should we pay for the repairs?

Reply to commentHello Manfred,

Thank you for your comment. In fact, radiators can be privately owned, while underfloor heating is communal. However, please understand that we are not permitted to provide legal advice. In the event of a dispute, we therefore always recommend advice from an owners' association such as Haus & reason or a specialist lawyer.

Best regards

the Immowelt editorial team

Metter on 01.07.2019 12:54

We are a 6-family house and three owners live in the house and three are investors.

Now an investor is selling the apartment.

Our reserves are quite high because the house water pipes are to be renovated.

What about the reserve? Does the selling owner get this paid out and how does the new owner have to react here? Does he have to pay this amount?

Reply to commentImmowelt editors on 01.07.2019 13:15

Hello and thank you for your comment,

There is no legal entitlement to a payout of the house money paid in. A new owner does not have to pay a certain amount either.

Best regards

the Immowelt editorial team

Metter on 05/25/2019 03:36

Dear Editor,

Our manager has increased management fees to an exceptional @38.50 per apartment per month.

The justification, with 6 units, this is so common in the Stuttgart area (c. 30 km around Stuttgart from Stuttgart), otherwise we can cancel.

Is that the norm?

reply to commentSascha on 01.07.2019 12:12

Hello... We are also facing the same issue. Have meeting on Thursday. 6 unit walk. Previously €24.00/apartment and €2.40/garage. Now it should be €36.00 + €3.60 when actually €56.00 according to the new administrator price list.

We have now looked for a new administrator, since we are a bit dissatisfied anyway. The price will then remain the same as before and hopefully more effort. But it's not easy to find one for small units. Also got 12 rejections. Also Stuttgart +30 km (near Herrenberg)

Immowelt editorial team on 05/27/2019 09:49

Hello and thank you for your comment,

We don't know exactly how much an administrator in the Stuttgart area costs on average, but such costs can still be normal depending on the scope of the administrator's activities. However, we would advise you to address your question again to a local owners' association (e.g. Haus & Grund).

Best regards

the Immowelt editorial team

Nala 1 on 05/17/2019 18:03

Hello everyone, since November 2017 we have owned an apartment in an 8-unit house that is managed by a property management company. At the owners' meeting in March 2019, it was decided that from April 1st, 2019, an outside person would be responsible for the caretaker and garden maintenance was charged with appropriate remuneration. In a corrected business plan for 2019, these costs were calculated retroactively from May 1, 2019 to January 2019.

The question also arises as to whether the salary of EUR 220.00 is subject to social security contributions. Many thanks in advance for your answer.

reply to commentImmowelt-Redaktion on 20.05.2019 09:21

Hello and thank you for your comment,

Income that does not exceed the limit of 450 euros is currently not subject to social insurance in Germany. To what extent the costs for caretaker and garden maintenance have an impact on the house money is in fact a matter for the owners' meeting. However, please understand that we cannot make a definitive assessment of individual cases from a distance, also because we are not allowed to provide legal advice. In the event of a dispute, we recommend that you speak to an owners' association such as Haus & reason or a specialist lawyer.

Best regards

the Immowelt editorial team

Cilli on 05/15/2019 19:05

Hello,

We are co-owners in a 3-family house. The garden is the private property of the other two.

We have to pay for the garden water as well. The administrator, who is a roommate, is not willing to show the garden water meter readings in the annual statement. What is my legal position?

Thank you for your reply.

Cilli

Reply to commentImmowelt editors on 16.05.2019 09:06

Hello and thank you for your comment,

In fact, there is no legal obligation to show the meter readings. However, the administrator would probably have to grant access to the documents on request, especially in the course of the review by the administrative advisory board.

Finally, please understand that we are not permitted to provide legal advice. In the event of a dispute, we recommend that you speak to an owners' association or a specialist lawyer.

Best regards

the Immowelt editorial team

guenther on 04/23/2019 17:39

Hello

I have received my housing benefit statement in the form of a summary of all owners.

It lists who paid what and whether a credit has been created or whether an additional payment is due. Is this even permissible in terms of data protection?

I would be very grateful for a short answer.

Best regards

Gunther

Reply to commentImmowelt editors on 04/24/2019 11:04

Hello Guenther,

Since the GDPR is still relatively new and as a result there are hardly any judgments, this cannot be answered conclusively. Basically, the GDPR aims at data economy, i.e. only data that is necessary may be processed and passed on. Whether that is the case with this compilation is likely to be a matter of interpretation.

Best regards

the Immowelt editorial team

Tati on 04/17/2019 20:33

Hello

I sold my apartment, from 01.01.2018 - 01.30.2019 I paid house allowance (key handover was 01.15.19. House money statement for 2018 year and credit gets my buyer. Is it correct?

Reply to commentImmowelt editors on 04/18/2019 08:30

Hello and thank you for your comment,

If no other agreement has been made, the point in time when the keys are handed over is not decisive, but when the new owner is entered in the land register. Either way, there is no entitlement to payment of a credit balance at this point in time, yes. Finally, please note that we are not permitted to provide legal advice. If in doubt, we recommend talking to a specialist lawyer.

Best regards

the Immowelt editorial team

Heribertam 14.12.2018 19:34

Got mold on the walls. Ventilating does not help because the outer walls have no insulation. Are the costs of interior insulation a matter for the reserve?

reply to commentImmowelt-Redaktion on 17.12.2018 09:20

Hello and thank you for your comment,

As a rule, there is only a claim to the assumption of costs by the community of owners if the reason for the mold formation comes from the community property. Since this is not easy to prove in practice, we would recommend that you seek legal advice, for example from an owners' association such as Haus & reason or a specialist lawyer.

Best regards

the Immowelt editorial team

Summer game on 10/14/2018 5:36 p.m

Can repair costs for a rented apartment be paid from the reserve pot of the homeowners' association? I thought the owner had to pay for it himself?

Mfg Heike Fichtel

reply to commentImmowelt-Redaktion on 15.10.2018 11:07

Dear Mrs. Fichtel,

Thank you for your comment. The community of owners is only responsible for repairs to general parts of the house, i.e. for the common property. Repairs to the private property of the individual apartment owners are generally their business. So it depends on the distinction between separate property and community property. For example, if an owner replaces the carpeting in his apartment, he has to pay for it himself, but this is already a matter for the community of owners when it comes to the windows. However, special regulations can also be made for this purpose in the declaration of division.

Best regards

the Immowelt editorial team

wind chime on 13.08.2018 10:00

hello! I've had a problem with co-owners of the house for about 2 years now because a plant is growing in the gutter that nested there at some point and it's easy to say that this plant is mine (it's near my balcony ) and therefore I have to remove them at my own expense! the property manager has known for a long time and yet I read in the minutes of the meeting that this topic was discussed and decided. a roommate who is a real estate clerk also told me that I have NOTHING to do with the distance of the plant because the gutter is communal property.

DAS must also have a property manager. know, he clearly should have said something when the meeting was, right? I'm grateful for a 100% safe tip, I want to have this topic finally settled. basically it's all about the fact that one person doesn't like the other and one uses every chance to 'pee on someone else's bottom'....and as is so often the case - whoever complains about others the most often keeps himself to himself NOT to the house rules etc. ...!

thank you

Reply to commentHello and thank you for your comment,

in fact, the gutter is one of the common parts of the house. Any repairs must therefore usually be paid for by the community of owners, unless it can be proven that a single owner caused the damage. We would therefore recommend that you seek legal advice on the matter, for example from an owners' association such as Haus & Ground.

Best regards

the Immowelt editorial team

Dinuta on 07/17/2018 12:05

Should tenant prepayments be placed in a separate account, or can they be paid directly into the utility account?

e.g. the tenant pays 175 euros for NK, but the housing allowance according to the landlord’s WP is 225 euros, is it enough to just fill up the difference and then pay it into the operating costs account?

Or the tenant pays 250 euros for NK, but the housing allowance according to the landlord's WP is only 225 euros, should the overpaid difference of 25 euros be placed on a sub-account for the NK advance payments for the tenant, so that there is a possible reimbursement then ready?

reply to commentImmowelt-Redaktion on 17.07.2018 12:24

Hello and thank you for your comment,

House money from the landlord and advance payments for ancillary costs from the tenant initially have nothing to do with each other. Not every item that the landlord pays with the housing allowance can also be passed on to the tenant via the utility bill. In principle, the tenant can pay the additional costs together with the rent directly into the bank account of the landlord. For accounting questions, it is best to contact your tax advisor directly.

Best regards

the Immowelt editorial team

Freystadtl on 09.05.2018 18:24

Can the rental deposit be repaid depending on the housing allowance?

Reply to commentImmowelt editors on 05/11/2018 09:53

Hello Freystadtl,

Thank you for your comment. The deposit is a security that affects the relationship between tenants and landlords, while the housing allowance is an advance payment by the homeowners to the homeowners' association. Therefore, no dependency would be apparent in this context.

For more detailed information, we recommend our guide to rental deposits: https://ratgeber.immowelt.de/a/mietkaution-rueckzahlen-nicht-ohne-pruefung.html

Please note, however, that we cannot provide legal advice. In case of uncertainty and for individual advice, we therefore recommend legal advice from an owners' association such as Haus & reason or a specialist lawyer.

Best regards

the Immowelt editorial team

Victor on 04/19/2018 09:55

Hello Immowelt editors,

Unfortunately, it is not possible to reply to your comment directly. So here again:

And how do you interpret this judgment of the BGH?:

Buyers are not liable for housing benefit arrears of the previous owner

Federal Court of Justice, judgment of September 13, 2013, AZ: V ZR 209/12

In principle, payment obligations arise within a WEG due to a decision. An apartment owner owes the "housing allowance" on the basis of a business plan approved by the owners' meeting or has to make additional payments if these result from an approved annual (individual) statement.

Although the buyer is fundamentally bound by resolutions that were made before becoming a member of the WEG, he is only liable for those liabilities that are established and due from the time of the transfer of ownership.

In the present case, an owner owed his housing benefit for the years 2009 and 2010 and insolvency proceedings were opened against his assets. After the apartment had been sold by the insolvency administrator at the end of 2010, the other apartment owners now asked the buyer to settle the outstanding amounts.

Wrongly so, as the Federal Court of Justice has now decided. There is simply no legal basis for such a demand. Insofar as the other owners had referred to Section 10 Paragraph 1 No. 2 ZVG, according to which housing benefit claims are preferred in foreclosure and insolvency proceedings, the effect of this provision is limited to that. However, this should not justify a new debt for the purchaser.

reply to commentImmowelt-Redaktion on 19.04.2018 10:00

Hello Victor,

In this case, it was probably less a question of when someone generally owes house money than of whether someone is liable for the previous owner's payment defaults. Of course, this judgment could also be interpreted in your favour. Unfortunately, we cannot judge from a distance whether it can be used in your specific case.

Best regards

the Immowelt editorial team

Victor on 04/19/2018 13:12

Thanks for the reply.

From your comment I gather that only after the change of ownership:

"Immowelt editorial team on 02/22/2018 12:32 p.m

House money is only due pro rata from the point in time at which ownership of a property has passed to you, i.e. with the entry in the land register."

Thanks anyway. It is clear that you cannot provide advice because these are often individual cases that can differ in small details.

VG

Victor

Victor on 04/18/2018 14:59

Hello Immowelt editors

In November 2017, I signed a purchase contract with the notary in which it was stated that I would not have to pay the purchase price before January 1st, 2018, even if all conditions for the purchase were met. Now everything has been delayed because of the bankruptcy administrator, because the apartment is from the private bankruptcy, it has been uninhabited for 2 years and the owner died a few years ago i. It was not until the end of March 2018 that the notary gave the go-ahead for the payments. The purchase price for the apartment was thus paid. At the beginning of April the excerpt from the land register came, showing that I am the owner.

Now the property manager wants the house money retrospectively from January 2018.

Have I understood correctly from the comments that I only have to pay the housing allowance after the transfer of ownership, i.e. entry in the land register, i.e. from April 2018 and not from January 2018 like the property management wants?

reply to commentImmowelt-Redaktion on 04/19/2018 09:02

Hello Viktor and thank you for your comment,

At least according to a judgment by the AG Herne (Az.: 28 C 46/13), the old apartment owner has to pay the ongoing house payments until the ownership is rewritten in the land register. Deviating agreements between the seller and the buyer have no influence on this and are irrelevant. Please note, however, that there is no final judgment on this question. In the event of a dispute, we therefore recommend that you seek legal advice from an owners' association such as Haus & reason or a specialist lawyer.

Best regards

the Immowelt editorial team

Viktor on 04/19/2018 09:53

Hello Immowelt editors.

And how do you interpret this judgment of the BGH?:

Buyers are not liable for housing benefit arrears of the previous owner

Federal Court of Justice, judgment of September 13, 2013, AZ: V ZR 209/12

In principle, payment obligations arise within a WEG due to a decision. An apartment owner owes the "housing allowance" on the basis of a business plan approved by the owners' meeting or has to make additional payments if these result from an approved annual (individual) statement.

Although the buyer is fundamentally bound by resolutions that were made before becoming a member of the WEG, he is only liable for those liabilities that are established and due from the time of the transfer of ownership.

In the present case, an owner owed his housing benefit for the years 2009 and 2010 and insolvency proceedings were opened against his assets. After the apartment had been sold by the insolvency administrator at the end of 2010, the other apartment owners now asked the buyer to settle the outstanding amounts.

Wrongly so, as the Federal Court of Justice has now decided. There is simply no legal basis for such a demand. Insofar as the other owners had referred to Section 10 Paragraph 1 No. 2 ZVG, according to which housing benefit claims are preferred in foreclosure and insolvency proceedings, the effect of this provision is limited to that. However, this should not justify a new debt for the purchaser.

müller_K on 04/07/2018 00:42

Dear Dr. Bruckner,

We want to buy an apartment in a single-family house. The house has two owners. We want to buy a share of the property. House was completely renovated in 2000. But there is no reserve. It is planned to set this up after we move in. After the declaration of division, we will own about 55% and family B, who have lived there for more than 17 years, will own 45%. The question is, if something happens after the move, e.g. a hole in the roof, how are the costs divided? Is there a law for this or do we have to sort it out before buying?

Best regards

Klaus Mueller

Reply to commentImmowelt-Redaktion on April 9th, 2018 9:00 am

Hello and thank you for your comment,

As a rule, the case you mentioned is regulated in the declaration of division. If costs arise on the house, for example repair costs for a dilapidated roof, and there are no reserves, there is a special contribution. The share the owners then pay is stated in the declaration of division. For example, it is possible to split the costs according to co-ownership shares.

Best regards

the Immowelt editorial team

Dietmar Winter on 07.03.2018 12:30 p.m

Dear Dr. Bruckner,

I've been the owner of an ETW since October 1st, 2016. Despite repeated references to the property management, no house money has been debited from me to this day that is on a separate rental account. Can I suffer disadvantages as a result and how long can the property management demand an additional payment.

Thank you in advance.

Best regards

Dietmar Winter

reply to commentImmowelt-Redaktion on 09.03.2018 10:12

Dear Mr Winter,

Thank you for your comment. Ultimately, it is the caretaker's fault if he does not debit the housing allowance from an individual apartment owner. The property manager could also be held liable for this by the community of owners. In general, claims for house money advances become statute-barred within three years.

Best regards

the Immowelt editorial team

ronnyroidmaier on 22.02.2018 10:09

Dear Dr. Bruckner,

I bought a condominium on December 1st, 2017.

Now there is a final statement of the ancillary costs from 01/01/2017 to 12/31/2017 (household allowance)

The previous owner has a difference of more than 100 € from 01/01/2017 to 11/30/2017.

Now the administrator wants me to pay these costs. Is that legal?

Thank you for the reply.

Best regards

Ronnie

reply to commentImmowelt-Redaktion on 22.02.2018 12:32

Hello and thank you for your comment,

House money is only due pro rata from the point in time at which ownership of a property has passed to you, i.e. with the entry in the land register.

Best regards

the Immowelt editorial team

Svenja on 02/19/2018 00:34

Hello Mr. dr Bruckner. The following facts: My current ex-husband and I bought a condo in 2013. I moved out of this after the separation and into my own apartment. My ex-husband stayed in the apartment with their two children. Child 1 moved to me in 01/2017. He and child 2 moved out in mid-2017. He paid the housing allowance, operating costs as well as credit and interest on his own. Now the sale is imminent and he wants a sum X from me after deducting the remaining credit and prepayment interest. Only then should the division in half take place. My question: Is it legal for him to ask me for house money (e.g. with a garage (he kept the car), maintenance of smoke detectors, cleaning of the stairwell, etc.) even though I have no share in the "consumption"? Of course I'm willing to pay half the loan and half the interest, as well as property taxes. Housekeeping from the vacancy date is also welcome. Many thanks in advance for your reply. Kind regards, Svenja

reply to commentImmowelt-Redaktion on 02/19/2018 09:27

Hello Svenja and thank you for your comment,

The situation is relatively complex and unfortunately cannot be clarified remotely without further detailed questions. Also because we are not allowed to provide legal advice, we would therefore recommend that you seek a discussion with a lawyer.

Best regards

the Immowelt editorial team

Tina on 07.02.2018 12:14

Hello, dear Dr. Bruckner,

Did I understand correctly that maintenance costs for heating, waste water pump, etc., costs for testing the boiler water for salmonella are part of the repair expenses and must be distributed according to co-ownership shares (if there are only three apartments).

I would be grateful for an answer.

Best regards

reply to commentImmowelt-Redaktion on 07.02.2018 16:47

Hello Tina,

Whether the cost items mentioned count as maintenance or repair work depends heavily on the individual case. The Operating Costs Ordinance defines maintenance work, among other things, as "regular checking of operational readiness and operational safety and the associated adjustment by a specialist". However, if this work goes beyond the mere inspection, care or maintenance of the system, the corresponding costs can also count as repair costs or maintenance costs.

Unless the apartment owners have decided otherwise, housing allowance (which also includes maintenance work on the communal property) and maintenance reserves are usually distributed according to the co-ownership share (§ 16 paragraph 2 WEG).

Please note that we cannot provide legal advice. If you need this, we recommend that you contact a specialist lawyer for home ownership law or consult a homeowners association.

Best regards,

the Immowelt editorial team

Frieda on 12/11/2017 08:35

Is it possible to achieve a real division in a 2-person community of owners (2 family houses, 3 garages, outbuildings and land)? What options are there?

reply to commentImmowelt-Redaktion on 11.12.2017 10:18

Hello Frieda and thank you for your comment,

A self-contained condominium that is part of a community of owners cannot be split again. However, it is undoubtedly possible for such an apartment to have several owners. They then own 50 percent of the apartment, for example, but not certain rooms.

Best regards

the Immowelt editorial team

Companies in the Pinneberg district...

Tips to do your electrical installa...

Maintal is becoming a smart city th...

New subway workshop and wash bay in...