There were three months on top of that this year, but by no means everyone has yet declared their taxes. But don't worry: we'll show you how to do it at the last minute.

Overview

Are you familiar with the problem? No matter how much time is left for a task, in the end we only finish it just before the end. It's no different when it comes to tax returns – many see them as a chore rather than a good opportunity to get money back from the state.

So there are likely to be some taxpayers again this year who are pushing the deadline to the last. It doesn't help that it was extended by three months until November 1st due to the corona. But don't worry: With our tips, you can get the tax return over with very quickly.

You can decide for yourself what is important to you: If you only want to satisfy the tax office and avoid late fees, simply enter the essentials. If, despite all the haste, you value the highest possible tax refund, we will show you which expenses you should invest a few more minutes in order to state.

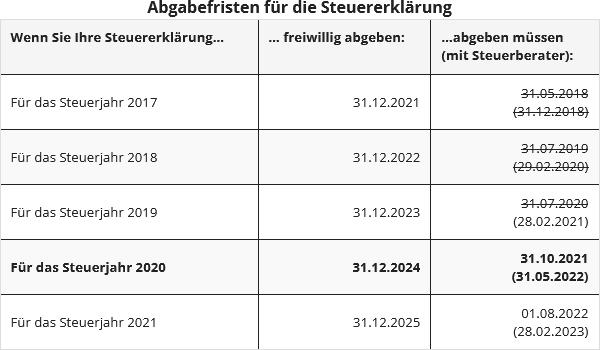

Important: Not everyone is obliged to submit a tax return to the tax office. Read here to whom the filing deadline applies and who can file their taxes voluntarily (and much later).

For those in a hurry

The deadline is getting closer and all you care about is fulfilling your obligations? Then simply focus on the forms you absolutely must submit in order not to pay a late payment fee. These include:

This will help you meet the deadline while still having the ability to claim additional expenses. Because you can still submit forms up to one month after receiving the tax assessment. How long is the objection period?

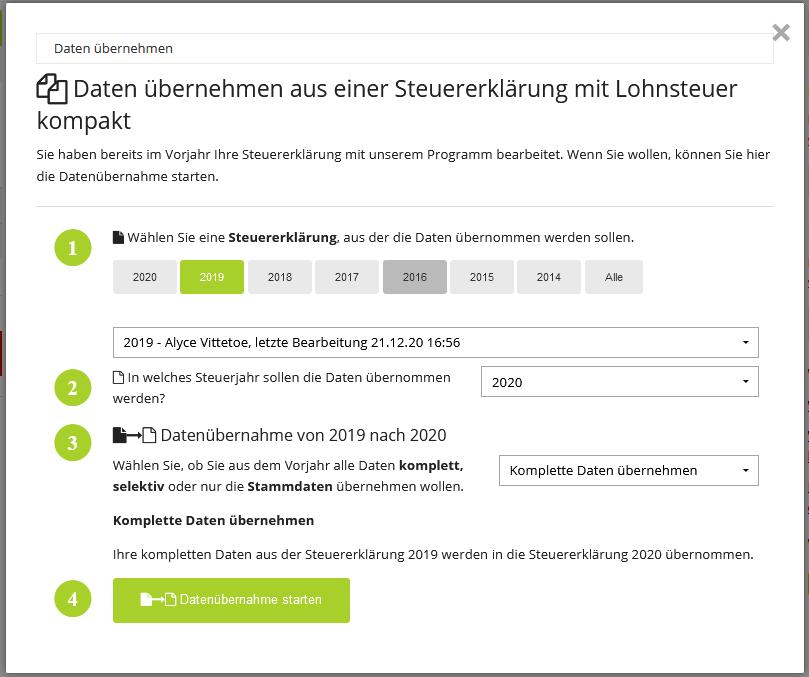

You can also push the pace if you are already registered with Elster. This is the free online portal of the financial administration. There you can still submit your income tax return on 1 November at 11:59 p.m. by the deadline. The same applies if you use tax software that is linked to the Elster portal.

DISPLAYComplete your tax return online: TaxfixComplete your tax return online: TaxfixAnd this has another advantage: the tax return has already been filled out. Thanks to the electronic data that the employer, health insurance company and pension insurance company transmit to the tax office, one click is all it takes to accept the information. If you have already entered items in the previous year that have not changed, such as name, address and account details, this work is already done. You can easily be done with your taxes in an hour.

Attention: If you are not yet registered with Elster, you can only use the portal shortly before the end of the submission period if the online function is activated on your ID card. Otherwise you will have to wait for mail from the tax office for registration. But that usually takes two weeks.

Those who submit their tax returns on paper also benefit from the electronic data. Fields that you can omit because the tax office already knows your data are marked in dark green.

If you have not yet registered with Elster and cannot do so in time, filling in the form is quite quick, even with the alternative. You can download the forms here and fill them out on your PC. If you are already too late for the post, you can put your paper tax return in the mailbox of your tax office yourself.

For cost-conscious people in a hurry

Anyone who wants to devote as little time as possible to their tax return but is still interested in a high repayment should provide some additional information. This applies to income-related expenses, special expenses, extraordinary burdens and household-related expenses.

Advertising costs

Here, the state grants you a flat rate of 1,000 euros anyway. Entries in the tax return are therefore only worthwhile if you are sure that you can exceed this mark. If this is the case, however, the following applies: every additional euro reduces your tax burden.

If, for example, you have set up a home workplace with office furniture, a new laptop, reading lamp, etc. during the pandemic, you should easily break the 1,000 euro mark. Because you also benefit from the home office flat rate of a maximum of 600 euros per year (read here who benefits in particular from the home office flat rate).

But please note: "If I've been working from home, I can't also add the commuter allowance for the same day," explains Daniel Schollenberger, tax expert at Wolters Kluwer.

Special expenses

There is also a lump sum for special expenses that is automatically granted to you. However, this is only 36 euros for singles and 72 euros for married couples or registered partners. It should therefore not be a problem for most taxpayers to prove higher costs.

The special expenses include, for example, contributions to pension, health, nursing care, unemployment, employment and disability, accident and liability insurance. In addition, payments into a Riester contract, church tax, maintenance payments and vocational training and childcare costs.

"Many people also donate. These expenses are also part of the special expenses," says tax expert Schollenberger. "For amounts under 200 euros, the bank statement is sufficient for the tax office as proof."

Extraordinary burdens

Most taxpayers gave up these items in the past because they assumed that they would not be able to exceed the comparatively high reasonable amounts anyway. However, it could soon be worth entering the costs for glasses, teeth cleaning and the like.

Because the Federal Constitutional Court is currently examining whether the high limits, which increase above all with the level of income, violate the Basic Law. If you enter the costs as a precaution, you will benefit from tax advantages in the event of a positive verdict.

"One is amazed at how much money one spends on health over the course of a year," says Schollenberger. If you have children, you can also state all medical expenses for the offspring in your tax return. Provided, of course, that you have worn them yourself - and not the health insurance company.

Household-related expenses

Quickly done, but often forgotten: If you hire someone to clean your apartment, iron the laundry, tend the garden or look after the children, for example, this is considered a household-related service and belongs in the tax declaration.

Even tenants benefit from this item if their landlord passes on ancillary costs to them. Just take a look at the utility bill: if you shared the costs for the caretaker, gardener or winter service, you can deduct the amounts from your taxes.

For those in a hurry who are unable to do so

Those who, despite all the last-minute tips, do not manage to submit their tax return on time, have another option: they can ask the tax office to extend the deadline. This can be done by phone, in writing or via Elster – ideally before the actual deadline.

However, you need a valid reason for this. This can be, for example, a longer hospital stay, moving house or bereavement in the family.

You should also enter a specific new date by which you want to submit the tax return. Realistically, about a month later.

For the very comfortable

If the tax office does not grant you a delay or you have come to the conclusion that you want to spend some money on your peace of mind, you still have the option of contacting a tax consultant or wage tax assistance association.

Because if you entrust a professional with your taxes, you have seven months longer - in pandemic times until May 31, 2022. Whether it is also financially worthwhile for you is another question.

Sources used:

How to get the perfect look for Cos...

Test winner at Stiftung Warentest:...

Dry elbows: This is how brittle ski...

Cream for Rosacea: The Best Creams