The cash Insider reports in the insider briefing prior to the market on the latest observations on what is happening on the Swiss market and is also active on Twitter under @cashInsider. Take a look at the tracker certificate on the Swiss stock favorites from cash Insider.

+++

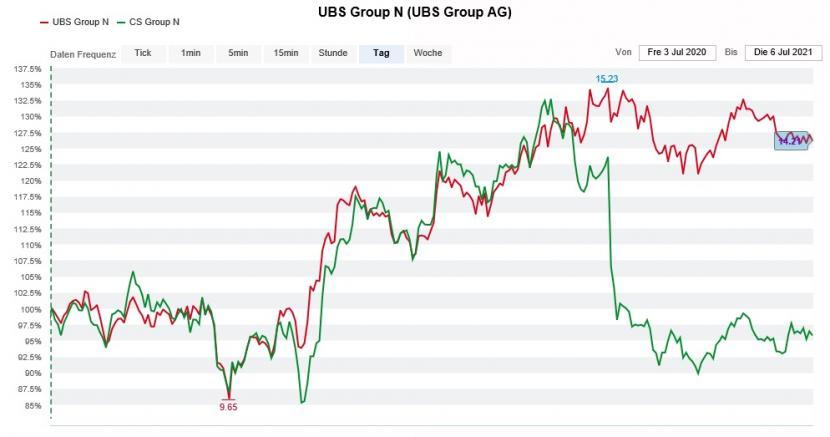

Actually, only a few steps separate the headquarters of UBS on Paradeplatz in Zurich from that of Credit Suisse. In terms of strategy, the two companies are not exactly dissimilar. On the stock exchange, however, the largest Swiss bank is worlds apart from its eternal archrival. Because while the shares of UBS cost almost 15 percent more than at the beginning of the year, those of Credit Suisse bring up the rear of this year's Swiss Market Index (SMI) with a minus of the same amount. But what a disgrace.

In a 44-page study on the European banking industry, however, UBS and its shares do not come off well. According to author Amit Goel - he is considered a profound industry expert - the big bank has a cost problem. The analyst sees costs rising further and restructuring costs under the new company boss Ralph Hamers.

That's not too bad. At least not as long as earnings remain strong. It becomes more problematic when the previously strong earnings situation begins to normalize.

UBS share price development (red) compared to that of Credit Suisse (source: www.cash.ch)

Goel therefore continues to classify UBS shares as "Underweight" and a price target of CHF 14 and has the shares on the so-called "Least Preferred List". Instead, the analyst relies on that of the problem child Credit Suisse, which also gives a deep insight. Incidentally, the latter are recommended with "Overweight" and a price target of CHF 12.50.

UBS' appeal process against the 4.5 billion euro fine in France is no less decisive than the ratio of costs to income. The big bank only recently suffered a minor partial defeat, as it can also be prosecuted for money laundering in view of the far-reaching judgment at the end of September...

+++

It's been quite a while since I last wrote about Kudelski. This may also have something to do with the fact that the technology company from a suburb of Lausanne has had to reinvent itself again and again in recent years. The new buzzwords are the Internet of Things and cyber security.

Actually, these two future business areas should not only be in tune with the times, but also with those of investors. After all, hardly a week goes by without there being talk of a major cyber attack somewhere in the world. The latest victim is the American software company Kaseya and allegedly a little more than 1,500 of its top-class corporate customers. The hackers - allegedly a Russian collective - are trying to extort ransom money.

But if you think that this news will breathe new life into Kudelski's shares, you're wrong. The opposite is the case: the papers have been wallflowers for what feels like an eternity. At the end of January, prices of 5 francs and more were paid at the top, recently it was only around 4 francs.

Price development of Kudelski shares over the last 12 months (source: www.cash.ch)

A possible explanation for the hypothermic reaction of the stock market is provided by analyst Andreas Müller from the Zürcher Kantonalbank. In a company study available to me from the end of February, Müller states that the cyber security business area is likely to contribute just 12 percent to annual sales. With the Internet of Things it is even just one percent. As a result, the Zürcher Kantonalbank continues to classify the shares as "underweight". That means roughly as much as that Kudelski investors are better off staying on the sidelines. UBS analyst Jörn Iffert is even clearer. He even advises to exit with "Sell" and a 12-month price target of 2 francs.

From the shareholders' point of view, the two outstanding bonds from the canton of Vaud remain an important indicator. While the bond, which matures in mid-August 2022, is now trading almost at par again, the bond with a two-year term is still available for just 90 centimes for every franc. And even if it wasn't 65 centimes at the beginning of the year, investors still don't seem to be completely convinced that the company can repay the bond maturing in 2024.

| The cash Insider takes market rumors as well as strategy, industry or company studies and interprets them. Market rumors are deliberately not checked for their truthfulness. Rumours, speculation and everything that interests dealers and market participants should be passed on to the readers quickly. No responsibility is taken for the correctness of the content. The personal opinion of the cash insider does not have to coincide with that of the cash editorial team. The cash Insider is active on the stock exchange itself. This is the only way he can achieve the market proximity necessary for this type of news. The opinions expressed do not constitute buy or sell recommendations to the readership. |

How to get the perfect look for Cos...

Test winner at Stiftung Warentest:...

Dry elbows: This is how brittle ski...

Cream for Rosacea: The Best Creams