Investors in the stock market are increasingly looking to invest in stocks based on environmental, social and governance factors - also known as ESG or sustainable investing. US sustainable funds saw $34 billion in inflows in 2021, according to Morningstar data.

The problem with this is that choosing the best sustainable investment can often prove difficult. Companies are often advertised as green investments, even though this stands in the way of their main business - keyword greenwashing.

Bank of America has also developed its own "ESGMeter" - a metric that identifies companies with "superior financial health" based on ESG attributes, according to financial news channel CNBC. The aim of this in-house development is to penetrate the ESG jungle. This was stated by analyst Xavier Le Mene in a statement at the end of January.

Le Mene and his colleagues used their own ESGMeter to identify investment ideas. The additional criterion, however, was that they were liked by the bank itself – but not by other analysts. "We identify 25 names for which the ESG Meter is high, which BofA analysts recommend buying, but for which the consensus is either neutral or negative," explained Le Mene.

Spirax Sarco - Efficient Use of Steam

One such stock is Spirax-Sarco. The British engineering company is a world leader in the control and efficient use of steam. This is at the heart of many industrial processes and is an integral part of Spirax-Sarco's customers' ESG strategies, Le Mene said.

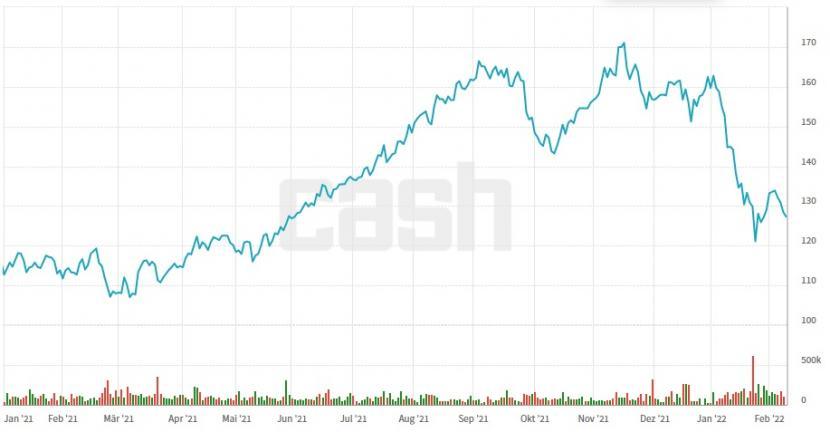

After a rapid rise last year, the engineering company's stock has come back strongly this year. The course minus amounts to minus 21 percent. However, the price-to-earnings ratio is still very high at 46.

Price development of Spirax-Sarco shares since January 2021 (source: cash.ch)

Equinor - offshore wind power

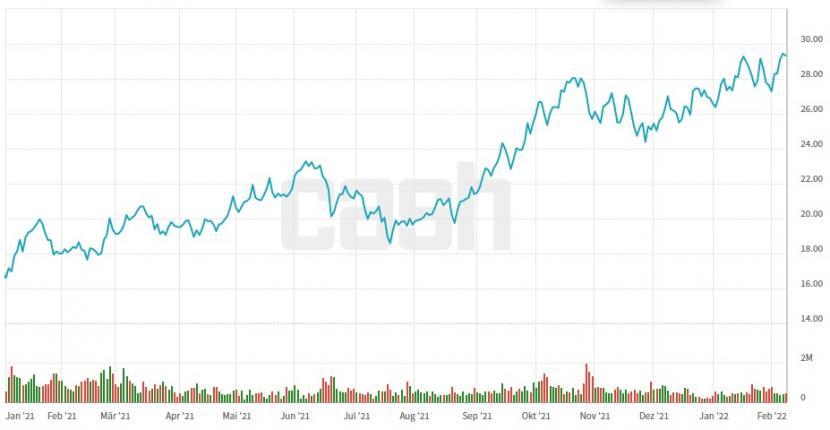

The Norwegian energy company Equinor is also on the Bank of America list. But in contrast to Spirax-Sarco, Equinor shares were able to continue last year's upward trend in the new year - plus 10 percent. The P/E ratio is 34. An investment offers a dividend yield of 1.7 percent.

Equinor share price development since January 2021 (source: cash.ch).

The company has built a renewable portfolio focused on offshore wind. Equinor is playing a leading role in the development of floating offshore wind technology, Le Mene said. The company could potentially dominate this key energy transition technology given its cost competitiveness, he added.

Big Yellow - 'green' bins

British self-storage company Big Yellow - the largest self-storage company in the UK - is another Bank of America favorite stock. The company aims to cover 100 percent of its energy needs with renewable energy by 2030, of which 50 percent will be solar energy. This should improve the company's environmental record for years to come, Le Mene said.

Big Yellow stocks have consolidated after a strong climb over the past year. Reasons to buy this stock are the low P/E of 6 and the dividend yield of 2.6 percent.

Price development of Big Yellow shares since January 2021 (source: cash.ch).

Signify - leader in smart and LED lighting

Bank of America analysts also favor Dutch lighting company Signify. After the stock had risen significantly up to the end of July last year, it came back in the second half of the year. Since the beginning of January, however, the share has been on an upward trend again. With a price-earnings ratio of 15, the stock is still cheap.

Signify share price development since January 2021 (source: cash.ch).

Le Mene names Signify as a leader in smart and LED lighting. The products help customers achieve energy savings. This is particularly relevant given current energy cost inflation, Le Mene said. The company's operations are also carbon neutral and use 100 percent renewable electricity, he added.

Warehouses de Pauw - “green” industrial real estate

Belgian real estate developer Warehouses De Pauw is another Bank of America favorite. Le Mene said the company is a green leader in industrial real estate, with about a third of its buildings powered by locally produced green electricity.

After a steady rise over the past year, Warehouses de Pauw's stock is showing signs of weakness in the new year. The course minus amounts to 16 percent. However, the PER of 7 and the dividend yield of 1.8 percent are a plus point for the Belgian stock.

Price development of Warehouses De Pauw shares since January 2021 (source: cash.ch).

ABB - well on the way to CO2 neutrality

With the energy and automation technology group ABB, a Swiss blue chip is also on the list. ABB's shares rose sharply last year through mid-August. After a correction in September, the stock continued its upward trend until the end of the year. Since the beginning of January, however, the share has shown weakness and is 6 percent lower.

ABB has reduced its absolute emissions by over 60 percent since 2015. Bank of America analysts said the company is also aiming to reduce emissions throughout its supply chain and achieve carbon neutrality in its own operations by 2030.

Heineken, L'Oreal, Terna Energy, Telefonica, JCDecaux and EDP Renewables

The bank's other "contrary" stocks include Dutch brewer Heineken, French consumer goods titan L'Oreal, Italian network operator Terna Energy, Spanish telecommunications company Telefonica, French outdoor advertising company JCDecaux and Portuguese energy producer EDP Renováveis.

How to get the perfect look for Cos...

Test winner at Stiftung Warentest:...

Cream for Rosacea: The Best Creams

Dry elbows: This is how brittle ski...